Don’t fight the Fed. Don’t fight price. The market can be “wrong” longer than you can remain solvent while in a “right” position. Phrases I’ve observed on FinTwit this past week. All I know is what the charts tell me, and that is the market continues to point up. Here are some interesting charts for your review.

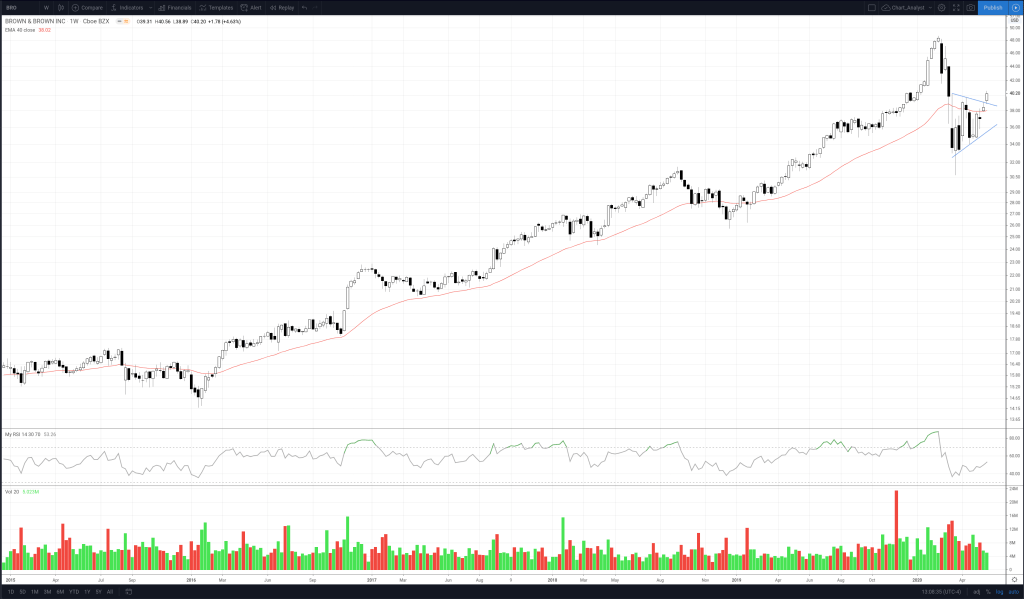

BRO, Brown & Brown, had a clear breakout of a small symmetrical triangle on the weekly chart. Above the 40 week EMA.

Note: to expand these charts, which you really need to do to see the detail, you must right click and select “Open in a New Tab”. Sorry for the inconvenience, but I do not have access to the WordPress Lightbox plugin, which allows for pop-out images.

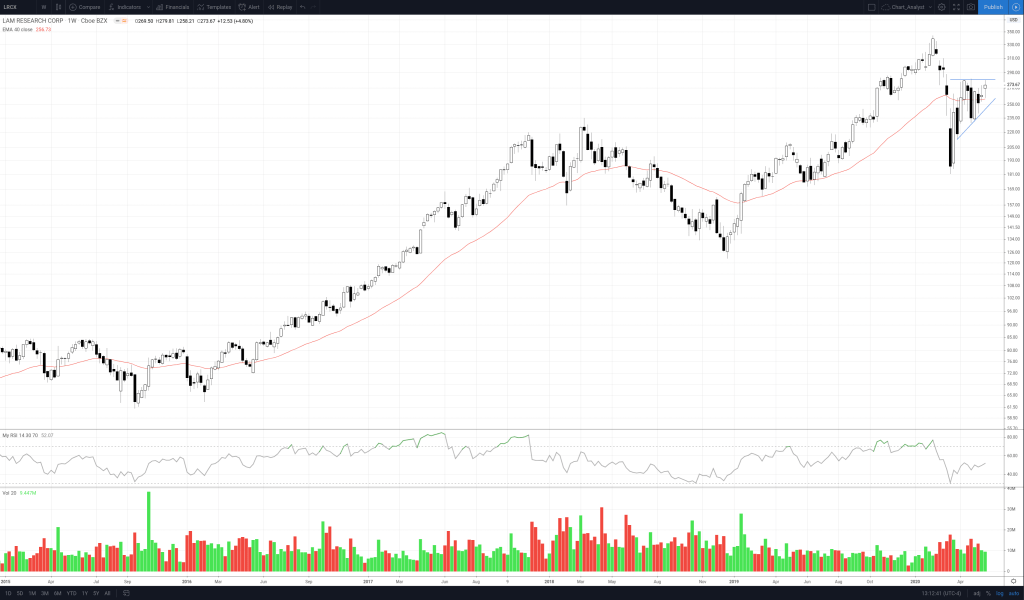

LRCX, Lam Research, tested the upper boundary of an ascending triangle and fell back. Above 40 week EMA, it could make another attempt next week.

MU, Micron Technology, is forming a 9 week ascending triangle inside a 26 month rectangle on the weekly chart. It is hovering around the 40 week EMA, and has tested the upper boundary of the triangle 3 times.

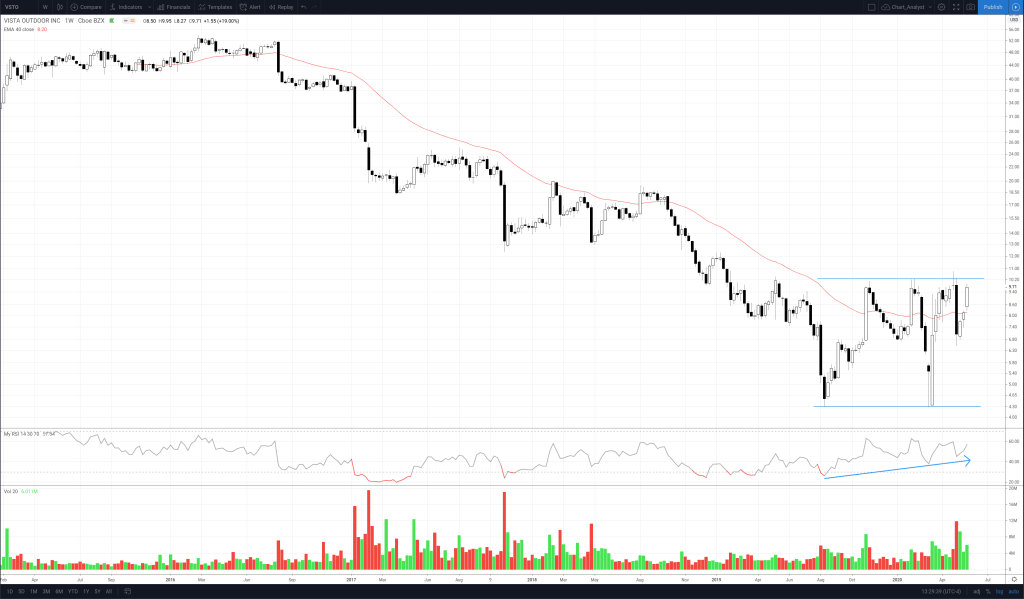

VSTO, Vista Outdoor, is the bottomfishing candidate for the week. It has formed an eight month rectangle at the bottom of a 3+ year decline. It is above the 40 week EMA and has a rising RSI.

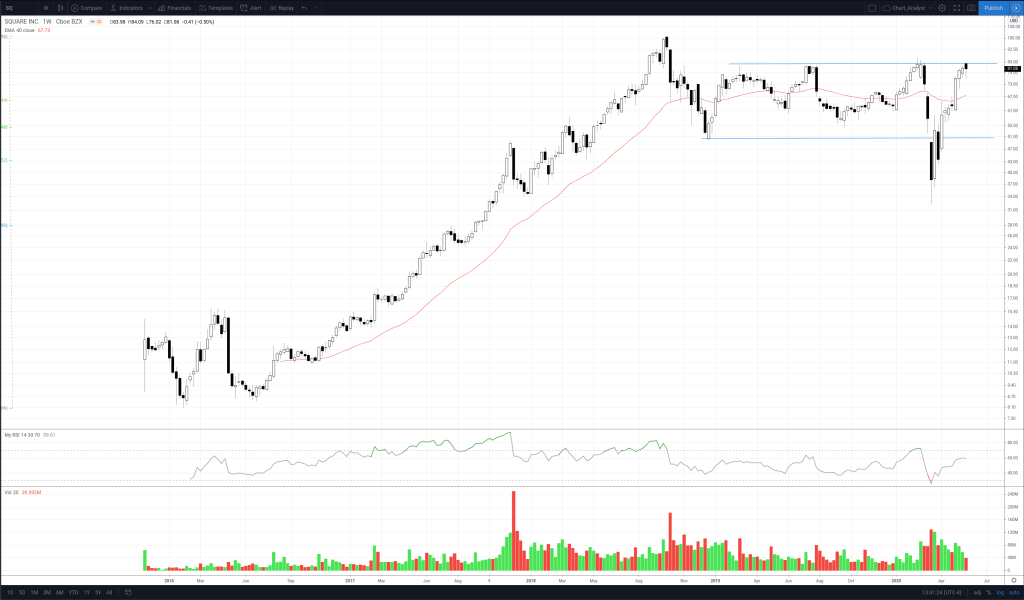

SQ, Square, has tested horizontal resistance four times in the past 16 months, the most recent test being this past week.

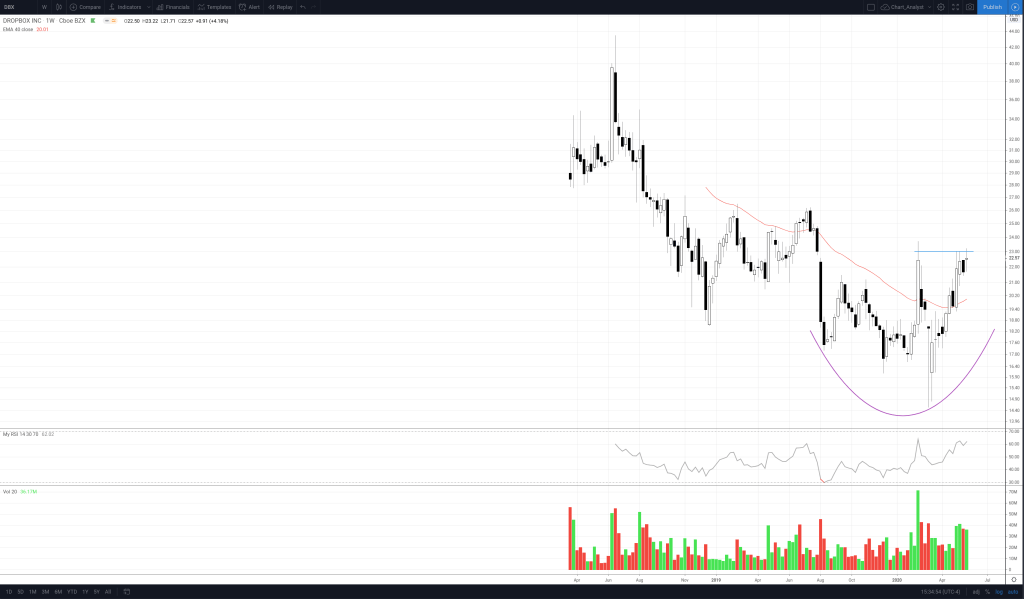

One more bottomfishing candidate is DBX, Dropbox. It has drifted down since it’s IPO in March 2019, but could be forming a bottoming pattern. Above 40 week EMA, rising RSI.

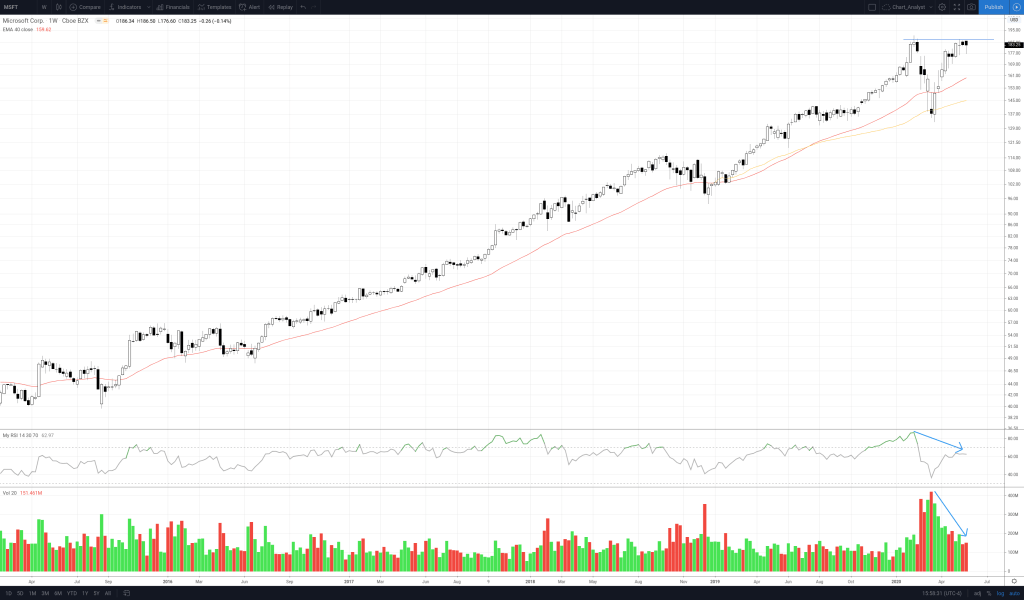

And let’s finish up with a double top in MSFT on the weekly. Hard to tell if this is going to resolve up or down at this point. But something to keep an eye on, could be an indication of some possible rotation coming up.