Are recreational drugs, tech and the government growth areas? Well, let’s see:

- Do we all need stress relief after the past few weeks? Check

- Are we gorging on social media and online conferencing? Check

- Does the government grow in times of emergencies? Check

It would not surprise me to see these trends continue after we recover from this recession. I don’t know the answer to the title question, but I do know some interesting looking REIT charts showed up in my latest screen. These are not your run-of-the-mill garden variety REITs that focus on home mortgages or generic commercial real estate. They have a special focus. And while I don’t necessarily see trade-able patterns on the weekly chart, I did see strength, absolute and relative. While the generic REITs are getting hammered, a select few specialty REITs are providing income and relatively stable price performance.

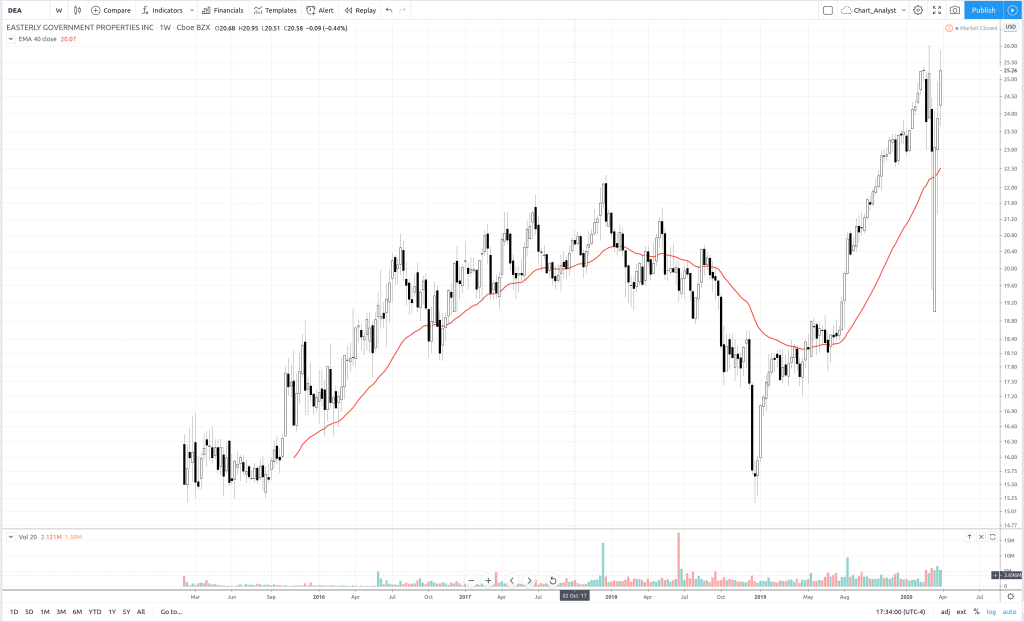

Easterly Government Properties Inc, DEA, has fluctuated with the market but has bounced back to all-time highs. The company is a REIT that leases properties to the US government.

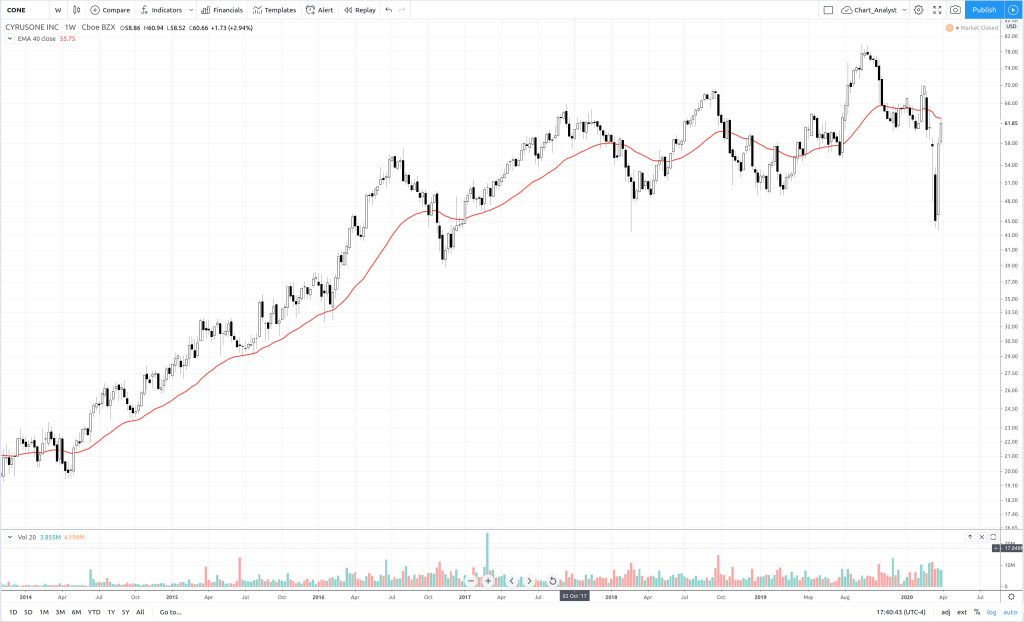

Cyrusone Inc, CONE, is a REIT that provides data center facilities for IT infrastructure.

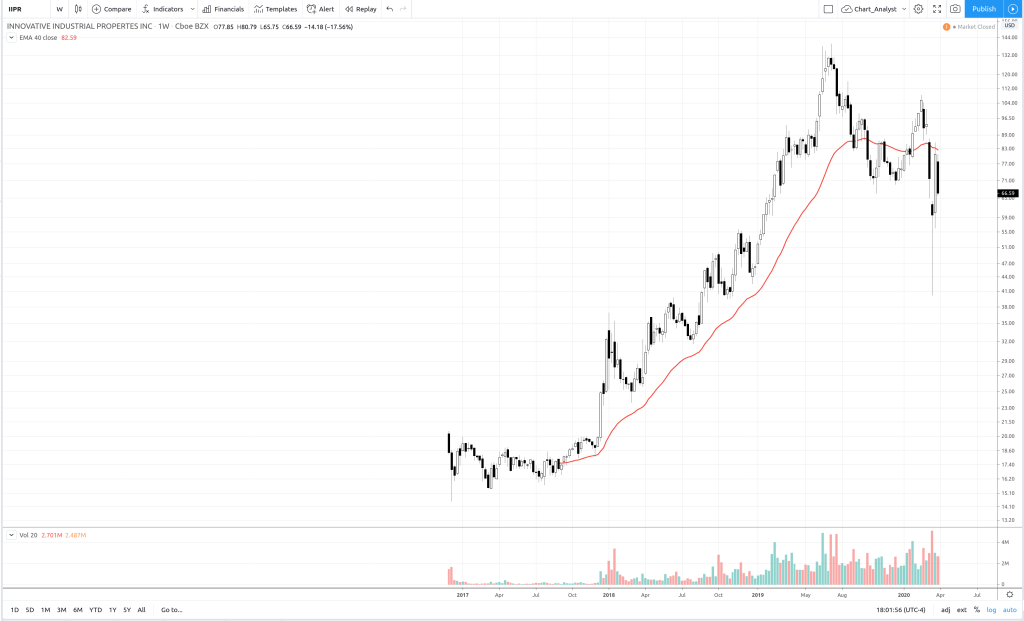

Innovative Industrial Properties Inc (IIPR) is a REIT that leases properties to marijuana growers. They express it in a more delicate fashion, but that is essentially where they focus.

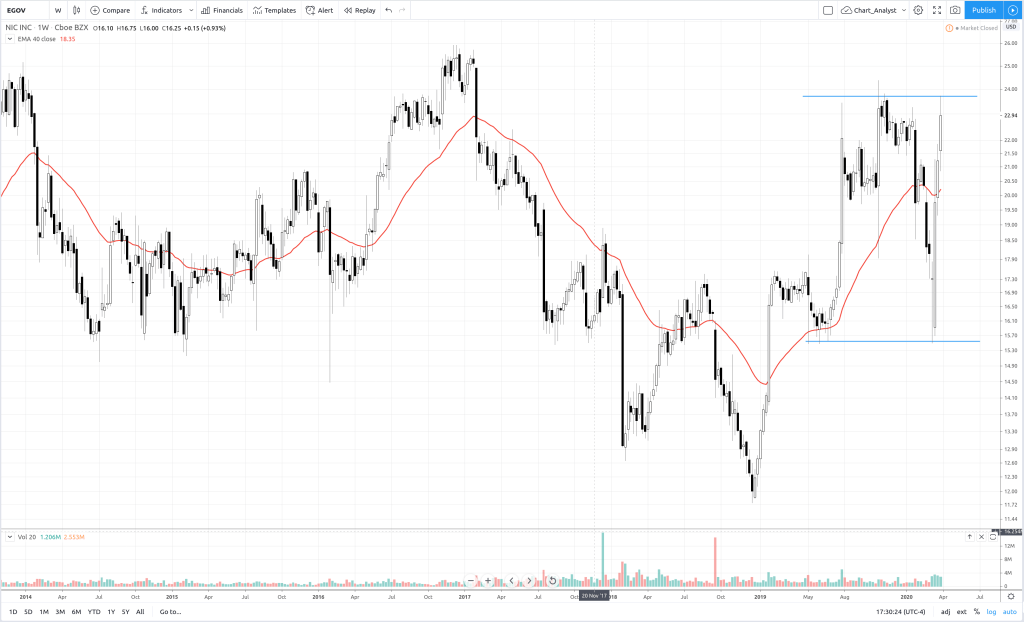

Moving away from REITs and on to Financial Services, NIC Inc, EGOV, combines technology and financial services to provide digital solutions and secure payment processing to governments.

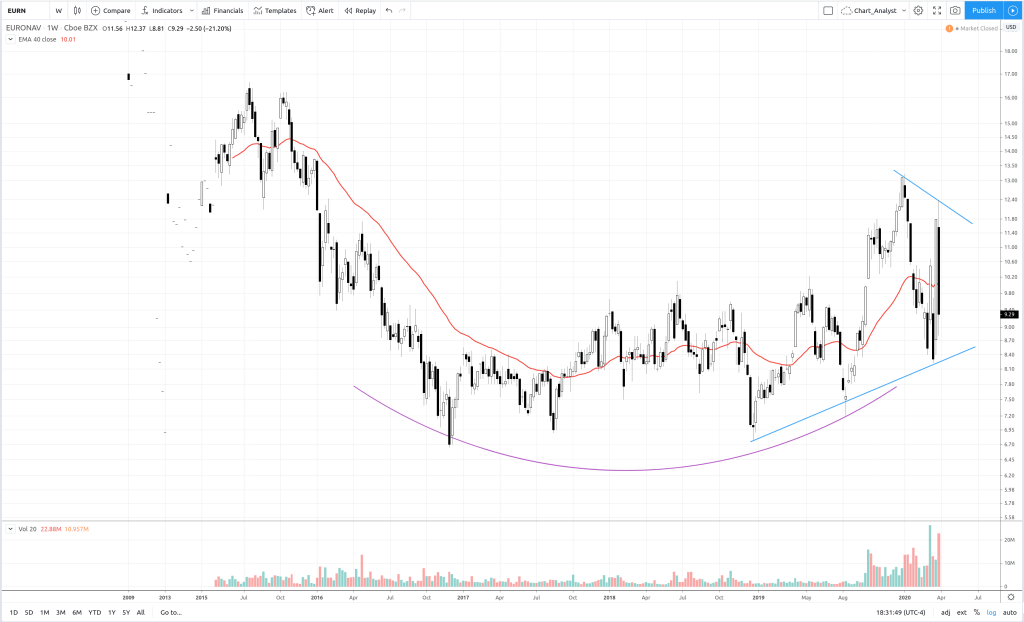

Euronav, EURN, engages in the transportation and storage of crude oil. Given that I haven’t bought a tank of gas in four weeks, I would suggest their storage business might be getting busy. The Saudis and Russians may kiss, make up and cut production, but they can’t make self-isolating soccer moms buy gasoline. EURN has formed a nice bottoming pattern and a series of higher lows, and is currently in a symmetrical triangle.

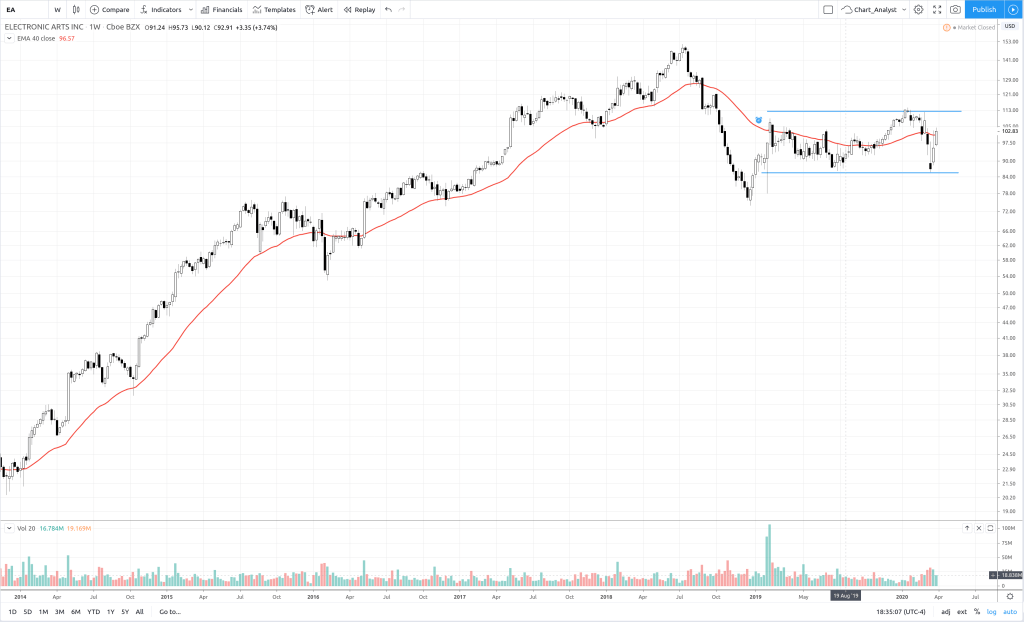

Electronic Arts, EA, is still in a 15 month rectangle sideways consolidation. It seems no one has informed EA that a pandemic is happening. 🙂

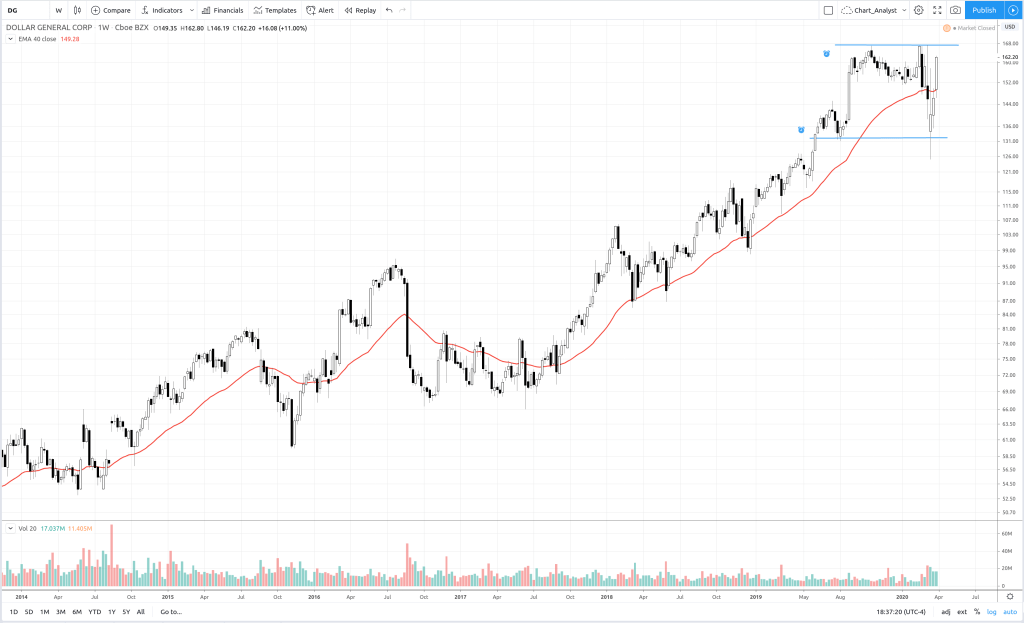

Let’s finish off with Dollar General, DG, good ol’ Consumer Staples, consolidating in a 9 month rectangle.