If you have the attention span of a gnat, don’t bother. This is a long post.

That’s where we are right now. The US markets have dropped 30% or so. VIX is dropping from the eye-popping 80s to the mid-sixties. Things are calming down, right?

Maybe so, but don’t let your guard down. We are in the eye of the hurricane. What do you do now? Think about it in the terms of a real physical hurricane. Some of you have been there. If you didn’t prepare, you cautiously emerge to take a peek. “Holy horse hooey, there is a lot of damage and this is disastrous.”

If you did prepare, you and your property likely suffered a few dings. You survey the scene and say “I can recover, I can fix this”. Then you scurry back inside to the safety of your bug-out shelter and uncork another bottle of wine, because you are in the eye and you know what is coming (actually you don’t start drinking – you stay sober, redouble your efforts and work harder. But it sounds comforting, doesn’t it?).

Which one are you?

In my case, I manage multiple accounts. Some are doing quite well and on the way to my usual target of 12% annual return. Others have suffered some damage, somewhere between the “Oh Crap” category and “I can fix this” category. Overall, I believe my situation is one of “I’m OK, I can fix this” (because I am an eternal optimist about these things, and capital has been preserved – with a little growth – in my long term accounts). In this post I’ll examine why the outcomes have been different for the various accounts. What good decisions were made? What mistakes were made? How can I learn and improve going forward? All of this will be done in general terms (to protect the innocent), but with enough detail to hopefully be of some help to readers.

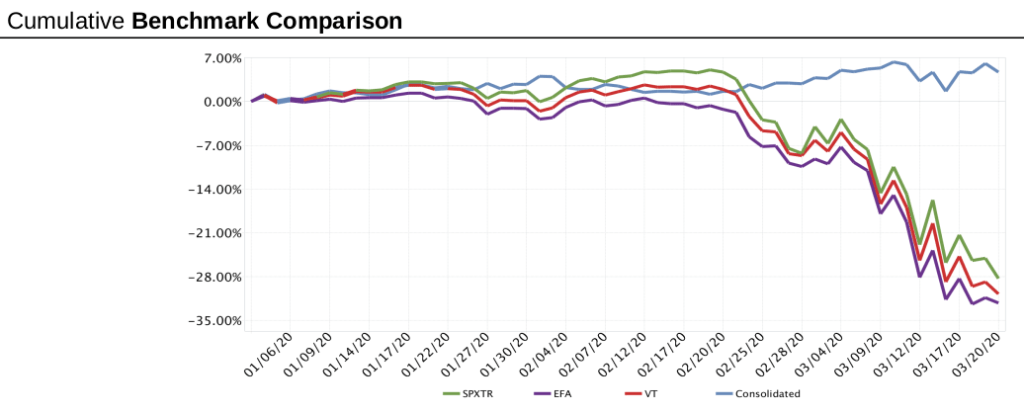

Let’s start with the good news, two of the long term retirement accounts. As of March 20, they are up 4.7% for the year. These accounts illustrate strong discipline and good outcomes. The chart below compares the cumulative accounts to the SPXTR (S&P Total Return, EFA (MSCI EAFE ETF) and VT (Vanguard Total World Index).

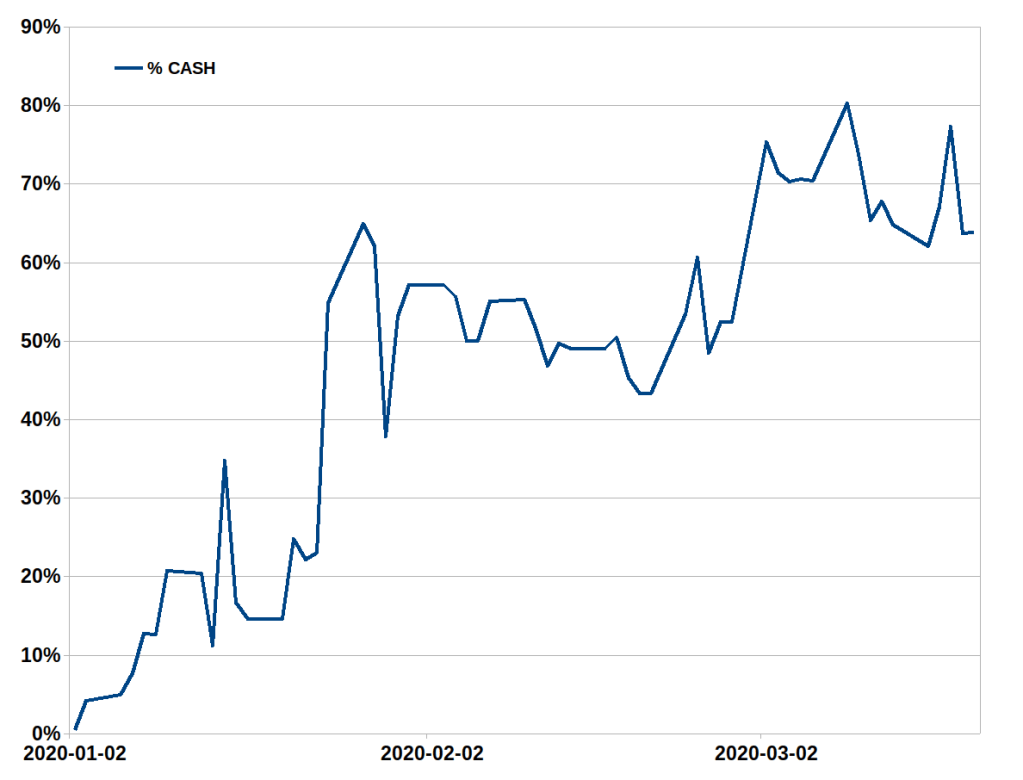

How was this accomplished? Basically by raising cash aggressively and putting hedges in place quickly. And executing my plan completely. These accounts were also re-aligned in August 2019. All losers were closed and stops & targets were put in place for ALL remaining positions at that time. Same for all new positions that were established subsequent to the re-alignment.

What did I do right?

- ALL positions had active targets and stops in place using one-cancels-other orders. These were put in place when the positions were established. No exceptions.

- Went to high percentage of cash early. This was automatic as the stops were in place. Small losses were taken. Highly recommended.

- If targets were hit, profits were taken. Automatically.

- Increased cash percentage as market continued to drop. Again, automatically.

- Bought SPY, SMH & IWM put hedges.

- Bought TLT & IEF as hedges.

- Bought utility stocks as hedges.

- Slowed number of trades dramatically.

- Still maintained my routine of reviewing weekly charts every weekend, but didn’t act on as many setups, as the market was volatile and whipsawing. It’s important to maintain as much of your routine as possible.

- Follow smart people on social media. More on this below.

What did I do wrong?

- Picked the wrong expiry on the first tranche of SMH & SPY puts. I was expecting a 5%-10% correction, and I thought it would happen quickly. Not so. I initially bought SPY & SMH puts with an expiry 3 weeks out, and I lost money on these.

- Once I had new longer term protective hedges in place, I was quick to take profits. In hindsight, I should have held on longer to this tranche.

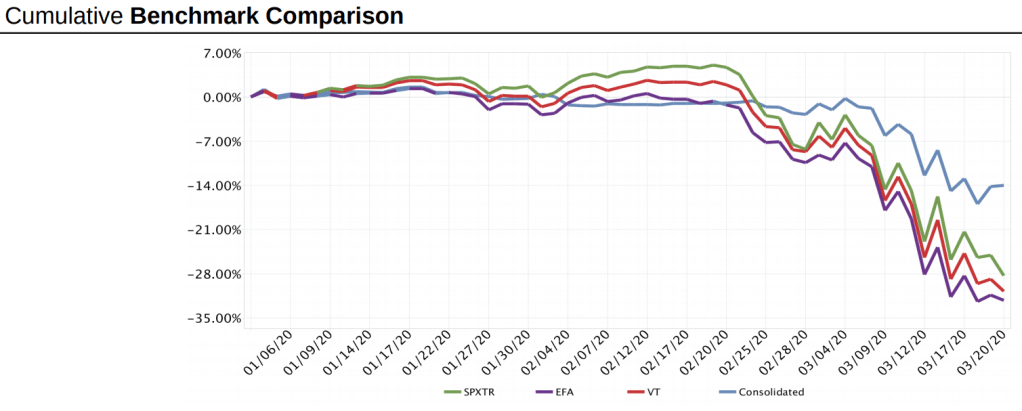

Next, here is a consolidated look at 7 other smaller accounts that did not fare as well. Performance was still better than the market, -14% vs -28% to -32% for the markets. But improvement is needed, and the performance of the accounts above illustrates how to get better.

What did I do wrong here?

- These accounts also went through a re-alignment in August 2019, getting rid of most of the losers. Emphasis on most – not all. And that’s where the problems began. I kept 3 of the losers, expecting improvement in them. I had good reasons for keeping all of them. Wish I hadn’t. If a stock is a loser during an uptrend, what makes you think it’s going to get better in a downtrend (of course in August I wasn’t anticipating a downtrend)? These were the biggest losers that pulled down the value the most in this downtrend (picture me banging head on brick wall).

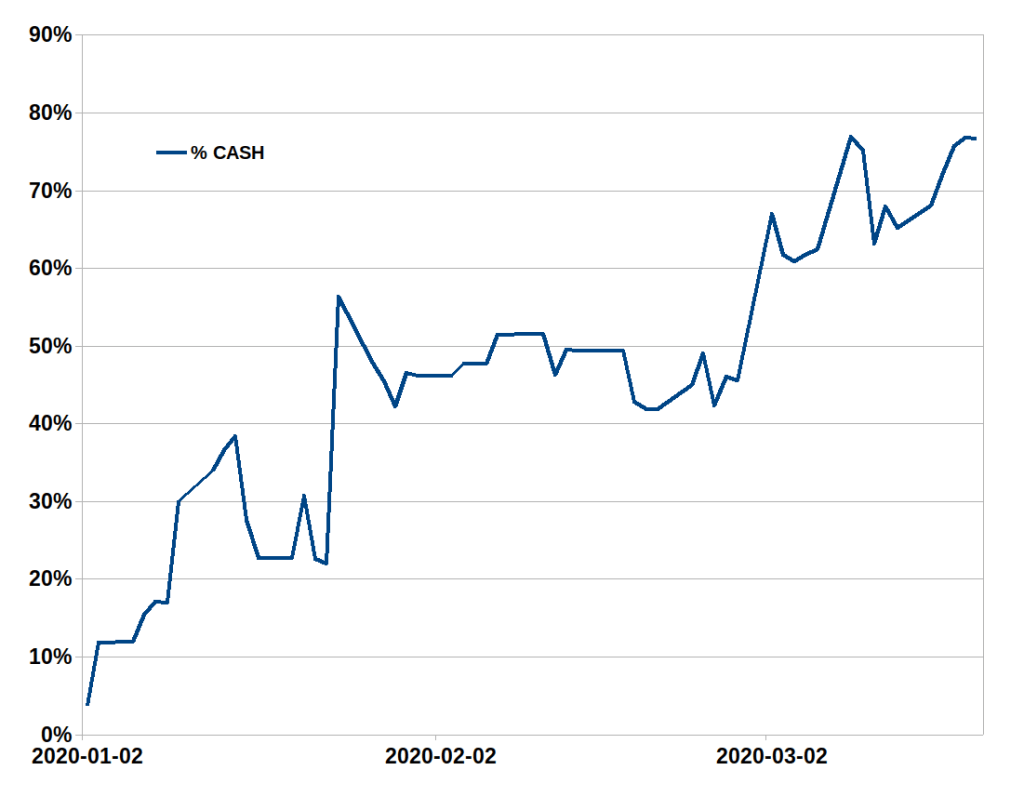

- I traded more frequently in these accounts. “Oh, this little correction is coming to an end, time to jump in again.” Wrong. Wait for signs of recovery. We are not there yet.

What did I do right? See “right” list above, it’s the same. I just didn’t do enough of it. Here’s the %cash in the account over time.

How can I improve? This is basic stuff. I knew it all prior to this downturn. But as the results from these two sets of accounts show, you have to execute on it. With discipline. You can’t do it halfway, or two-thirds, you have to do it completely.

- Have a plan.

- Execute the plan with discipline in all accounts.

- Get rid of all losers. This and execution were my biggest mistakes. Never hold a loser again.

- Put stops and targets in place as you initiate positions, move stops up with price. Do not move stops down, ever. This is the most important thing you can do to preserve your capital. Except options, I always manage these manually.

- Take the small losses now, which keeps you from having to take big losses later.

- When buying option hedges, double or triple your time estimate on expiries. Or have a plan to roll your put hedges every month.

- Bond and/or utility ETF hedges should have stops and targets, just like any other position (I did do this).

So there you have it. We will get through this, and we’ll be in a better place afterwards. But don’t forget, we are still in the Eye of the Hurricane. It ain’t over til it’s over. Be careful out there.

Smart people to follow on social media. Pay attention when these people post on Twitter.