Well. I took a few weeks vacation, and the market went to the house of Hades in a handbasket and the COVID19 issue developed into a world pandemic. How quickly the world can change these days.

What is the market going to do now? I don’t hesitate one second to say I haven’t the faintest idea. And neither do you, or anyone else. We are in uncharted territory, and these are watershed events that will likely bring about major change. I have purposely eliminated targets from my charts this week. I don’t want to imply I know where a stock is going (I don’t), and I don’t want to tempt investors. Targets are easy to calculate – do so, and make your own decisions.

The watchwords of the day are Risk, Uncertainty, and Volatility. Above all else, preserve your capital in the days ahead (I realize that for many, this is a “water under the bridge” issue). I will repeat my words from a previous post on February 1, 2020 (the TLT and IEF ETFs hit targets, moved to extremes, and are retracing, so you may want to avoid those):

- Reduce your current positions.

- Reduce your hold time. Take profits quicker, and get out of losing trades faster.

- Reduce your risk. Risk-off instruments include bonds and utilities (see TLT, IEF, ED and BKH from previous post). Initiate hedges such as buying index puts. Raise cash.

- Reduce the number of new trades that you enter. Slow down.

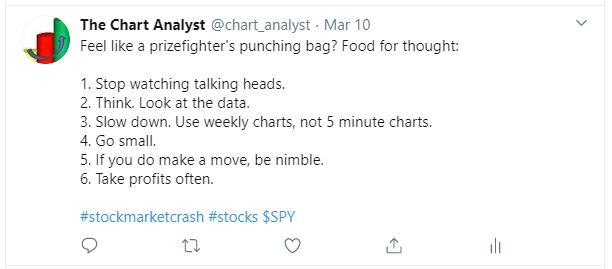

I will add to this some comments I posted on Twitter on March 10, 2020.

So, where do we as investors go from here? If we have a good plan, we stay the course. We review, assess, evaluate and execute. In my case, I am still screening thousands of stocks and ETFs every weekend and looking for patterns. A huge number of stocks that demonstrated patterns prior to the downturn are now no longer valid. But some still are valid, so we look to these for possible new positions. In addition, I’m looking for relative strength. Which stocks are holding up in this downturn? Which stocks are recovering the quickest? Which ones have the most stable financial position? Which ones are in strong uptrends, and might be “buy the dip” (or sell OTM puts for premium) candidates? These are the ones we want to focus on for future long positions.

Which sectors are exhibiting strength? Strangely enough, China. Note that when I say “strength”, I am saying they are still trading within the pattern that existed prior to the downturn. Not necessarily breaking out or even threatening to. Below are charts for the China FTSE 50 ETF (AFTY) and the China CSI 300 ETF (ASHR).

Again, it may seem strange that Chinese markets are exhibiting strength considering the pandemic that they are recovering from, but I strongly suspect the Chinese markets are getting LOTS of government-based support. See how Premier Xi is holding up the market in the chart below. 🙂

The medical sector is another place to look. The US Medical Devices ETF (IHI), is in a strong uptrend. It has broken below the 40 week EMA, but recovered back above the uptrend line.

The Biotechnology ETF (IBB), traded ~mostly~ within the existing ascending triangle pattern.

United Health Group (UNH) is still trading within a 15 month rectangle, above the 40 week EMA.

Penumbra (PEN), in the Health Technologies/Medical Specialties sector, attempted a breakout 4 weeks ago, and has held up well in the downturn. It is in a 9 month ascending triangle.

Technology is also showing relative strength, as illustrated by the QQQ and XLK (Technology Sector) ETFs.

Walmart (WMT) is hanging around the 40 week EMA in a descending triangle.

Data Processing/Payment Services are a good place to look, see Paypal Holdings (PYPL). Trading within a 9 month rectangle and above the 40 week EMA.

I think that will do it for this week. I have not even begun to look through the charts for short candidates (likely there are zillions). I generally don’t do much shorting, but I did recently close shorts on BA and NSSC. BA was mentioned as a possible short in the December 21 2019 blog post.